As a researcher in GrantStation’s Canadian Charitable database, one of the perks of my job is something quite unexpected: gazing at the photos of vast open Canadian landscapes gracing the pages of funders’ websites, many of which feature images of snow-capped mountains, glassy waters, and even furry wild creatures. From a research perspective, I thought it would be interesting to take a birds-eye view of Canada’s philanthropic landscape, looking out for any patterns or trends that may be on the horizon. This article will include an analysis of Canadian government funding and individual donations, while a subsequent article will examine corporate giving and foundation grants.

Government Funding:

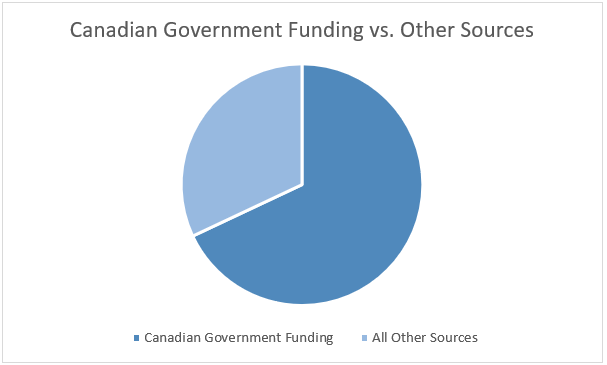

If there were a Mount Logan of Canadian charitable giving, it would be the government of Canada. According to The Giving Report 2018, published by CanadaHelps, in 2016 alone a staggering $177.2 billion in federal funds was doled out to Canadian charities. This figure makes up 68% of total charity revenue across Canada.

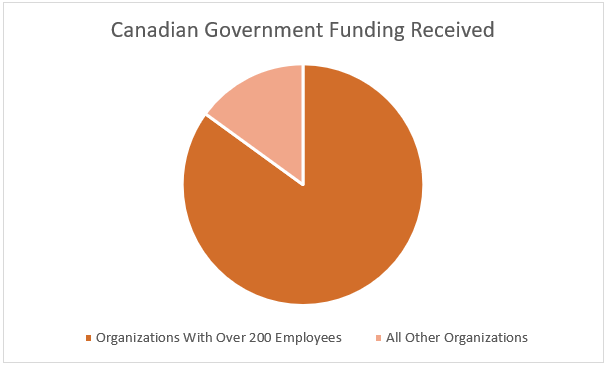

What does this mean for the average Canadian charity? The answer to this question largely depends on an organization’s size. According to the report, “a closer look at the numbers reveals the vast majority of government funding is directed at a tiny subset of large charities, leaving Canada’s small charities out in the cold.” More specifically, organizations with over 200 employees, which account for 1% of all Canadian charities, receive 85% of all government funding.

For small charities with ten or fewer employees, government funding makes up just 27% of funding from all revenue sources, compared to 79% of funding for charities with more than 200 employees. With small charities more heavily dependent on support from non-government funding sources, they may have to be more creative in order to cobble together the funds necessary to keep afloat.

But it’s not all bad news. The Canadian government recently announced the creation of a $755 million Social Finance Fund, aimed at boosting innovation among social purpose organizations by providing them with access to financing. With an additional $50 million set aside to build the capacity of organizations to participate in the social finance market, this is welcome news for smaller organizations looking to reach a higher summit.

Individual Donations

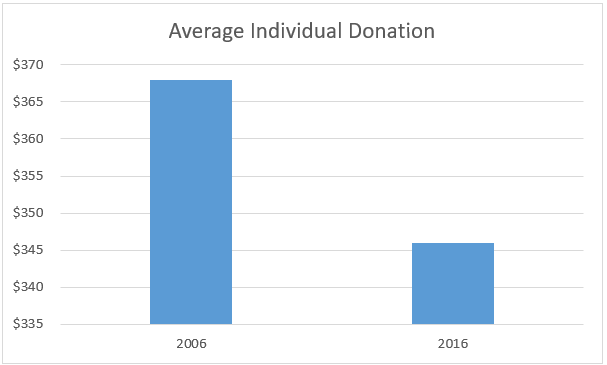

Can individual donations make up for the lack of government money available to smaller organizations? Again, the findings of The Giving Report 2018 point to troubled waters. Although total charitable donations increased from 2006 to 2016 (from $9.4 to $9.8 billion), this increase has not kept pace with Canada’s population growth. As a result, the average donation per individual has dropped from $368 to $346.

In addition, the report points out “significant declines in donation rates among Canadians of all ages, decreasing between 4-6% in almost every age group between 2006 and 2015.” This finding seems to be corroborated by the report 30 Years of Giving in Canada, which states that “With the economic downturn of 2008, the amounts claimed by donors began to fluctuate while the percentage of taxfilers claiming donations continued to decline.”

Upcoming demographic changes will likely exacerbate this problem. Currently, by far the most generous givers are Canadians in their golden years. Research by Statistics Canada indicates that in 2013, donors aged 55 and older were responsible for 47% of the total amount of all charitable donations, giving an average of $702. However, as the population shifts and younger Canadians move into this 55+ age group, it is forecast that there will be a subsequent drop in charitable donations, resulting in an even wider ‘giving gap’.

Some of these shifts may be attributed to differing cultural norms among younger generations. The report How Canadian Millennials Give, by the Rideau Hall Foundation, analyzed the giving behaviors of individuals born between 1980 and 1995. It found that “Millennials are not content with ‘passive donations’; they would prefer direct involvement and evidence that their support is helping.” Thus, organizations may be able to boost donations from this group by providing them with opportunities to volunteer.

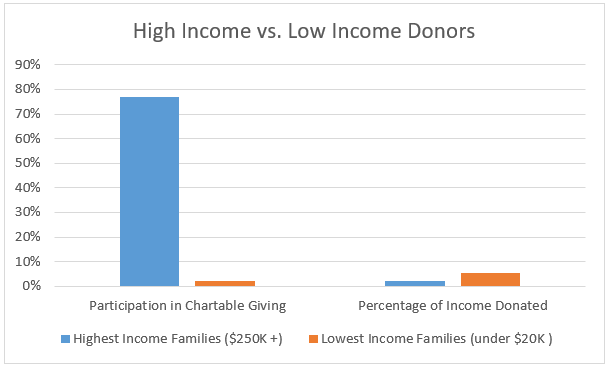

Interestingly, The Giving Report 2018 also reveals that the most dramatic drop in average donation amounts occurred among families in the top three income brackets, who decreased annual donations by 4.2 to 4.9% from 2006 to 2016. In contrast, although donation rates among families in the lowest income group (under $20,000) dropped from 5.8% to 2.3%, those that were able to give increased their donations by more than two percent of their income over the same period. Families in the highest income bracket ($250,000+) gave at very high rates (77%), but the percentage of their 2016 income dedicated to charity (2%) was much lower than that allocated by families in the lowest bracket (5.5%).

With the vast majority of lower income families unable to afford donations, and the highest earners tightening their belts, what does this mean for Canada’s charitable sector? One possibility is that societal shifts such as growing inequality may end up decreasing individual donations even further, putting more pressure on organizations to search for other sources of funding. Luckily, initiatives such as The Giving Pledge are encouraging wealthy individuals to give back more to their communities.

In addition, Canadian charities have more resources than ever at their disposal to help them reach individual donors. Examples include online fundraising platforms such as CanadaHelps and prospect research tools such as CharityCan.

Final Thoughts

With government funding disproportionately benefiting larger organizations, and individual donors tightening their purse strings, Canadian organizations must diversify their funding sources in order to remain competitive. In the next installment, we will examine the Canadian corporate giving and foundation landscape, including trends affecting organizations based on their geographic location and mission focus.

- Click on the links above to review the reports and resources mentioned in this article.

- Become a GrantStation Member to access the Canadian Charitable database, which features current information on foundation and corporate grants, as well as opportunities from faith-based and other types of grantmakers.

- Use your GrantStation Membership to research Canadian Government Grants & Loans.

- Visit GrantStation’s PathFinder website to discover additional reports to help you keep up on the latest philanthropic trends.